Links to various Aetna Better Health and non-Aetna Better Health sites are provided for your convenience. Aetna Better Health of California is not responsible or liable for non-Aetna Better Health content, accuracy or privacy practices of linked sites or for products or services described on these sites.

How one Florida nonprofit is helping families lift themselves out of poverty

By Bonnie Vengrow

By Bonnie Vengrow

It’s a warm March evening in Fort Lauderdale, Florida, and Cynthia Harden is rubbing goosebumps on her forearms. Not from a chill, but from the thrill she gets describing how, over the last two years, she and her husband have paid off their debts, upped their credit scores by more than 300 points and, now, are saving to buy their very first home for their family of six.

Cynthia’s accomplishment is significant, especially in this area. Though just a short car ride away from the city’s oceanfront mansions and high-end resorts, this part of town is known for its crime, poverty and lack of affordable housing.

So, the goosebumps make sense. As she sits in the Jack & Jill Children’s Center, where two of her children attend school, Cynthia is just a few feet away from the classroom where she took a life-changing financial literacy class. It was there she learned how to set a budget, build savings and tackle debts one at a time.

“I wanted my family to do better, and sometimes that starts with managing your money,” Cynthia says of enrolling in the class. Even though she’d arrive at class exhausted from a long day of work, Cynthia was a model student. She took notes, asked questions and used the lessons to whittle down her and her husband’s debts. Cynthia is the first to say the hard work and sacrifice were worth it. “After the first creditor sent me a letter saying the debt was paid in full, I felt so good because I did it myself,” she remembers. “I said, ‘OK, I can do the next one!’ That class helped me tremendously.”

Breaking the cycle of poverty

Jack & Jill Children’s center has been a fixture in Ft. Lauderdale since 1942.

For the past 75 years, Jack & Jill Children’s Center has opened its arms to more than 14,000 children and families in need. Ninety percent of its parents are single moms who support two or more children on less than $26,000 a year. Some are escaping abusive homes, others are sleeping in cars, and many struggle to make ends meet.

But assistance here goes beyond handing out bags of clothes and food. To truly help lift families out of poverty, the nonprofit provides comprehensive support for children and parents. For children, there’s the award-winning early childhood education center. (Currently, it cares for children 6 weeks of age through first grade. Next year it will expand to second grade, and in 2020, it will open a stand-alone elementary school in the lot next door.) There are after-school activities and summer camps, on-site dental check-ups and vision screenings, therapeutic services, nutrition programs and a garden that provides ingredients for the kids’ healthy meals and snacks.

A large garden in the center’s play yard provides ingredients for healthy meals for the children.

For parents, there’s emergency assistance, case management and a year-round calendar of programs designed to help families thrive in the long run. The financial literacy course is one such example. It teaches parents how to get control over the number-one source of stress ― money ― so they can focus on what really matters: their families.

Teaching the basics

“A few years after I started working here, I saw that financial literacy was a huge need,” says Jeanette Johnson, director of the center’s Family Strengthening program. So, she struck a partnership with a bank. The result of this collaborative effort is a six-week boot camp on the basics of finances. To make it easier on working parents, classes take place in the evening and the center provides free dinner and childcare. The course includes saving and spending habits, budgeting, credit scores and managing debt. The final session, led by a fair housing nonprofit, focuses on housing discrimination, a particularly pressing issue for families in this area.

Over the years, the lessons have been shaped by the needs and interests of parents, says Ashley Riggs, Family Strengthening program manager. Now, for instance, there’s a separate six-week course devoted to educating first-time homebuyers. And earlier this year, Riggs tapped a local couponing expert to lead a class in how to use coupons to trim everyday expenses.

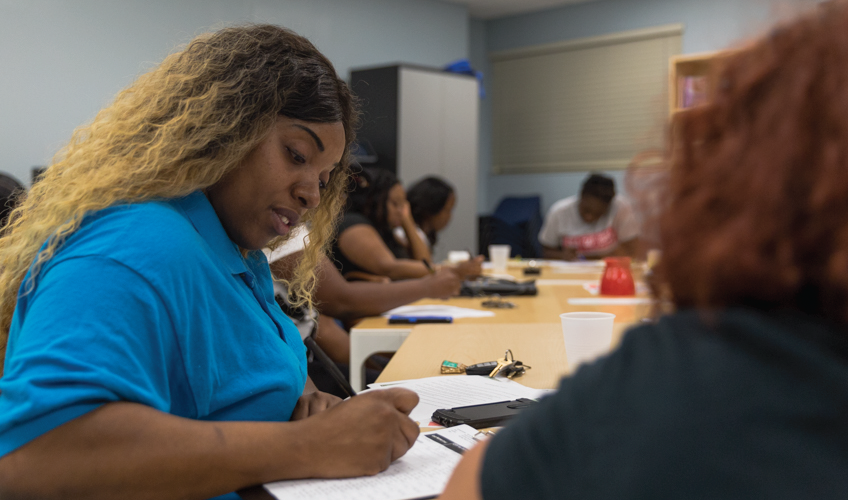

The financial literacy course teaches parents essential money management skills, like budgeting and saving.

Teaching proper spending and saving habits extends to children at the center as well, says Heather Siskind, the center’s executive director. School-aged children at the center can earn “J&J dollars,” which they can save, give to a friend or use to purchase goodies and trinkets from the “J&J Store.” And there’s talk of possibly teaching those same students age-appropriate lessons about spending and saving.

This kind of information isn’t just good to know ― it can be a stepping stone to a healthier, more stable life, Siskind says. “The financial literacy piece is really the foundation level for families,” she says. It empowers families to pursue better-paying jobs, achieve a better education, live in better housing, drive better cars, manage spending and budget for the future. “That’s the baseline. That’s the foundation for the rest of their success,” she adds.

Children at the early childhood education center receive “J&J dollars,” which they can use to buy goodies at an on-site store.

“Supporting families as they find a solid financial footing pays countless dividends,” agrees Amy Clark, senior program officer at the Aetna Foundation, which awarded the center a $100,000 Cultivating Healthy Communities grant for the financial literacy and nutrition programs and the garden. “Through our partnership with Jack & Jill, we’re able to impact parents’ short-term goals, such as reduced stress and improved job prospects and housing. These short-term achievements set the stage for longer-term benefits, such as having breathing room to invest in new educational opportunities for themselves and for their children. As these investments bear fruit and translate into stable, healthy living situations, the impact becomes multi-generational and will be felt by the children’s children.”

The center often partners with local farmers to offer families fresh produce.

Seeing results

The success of this program, now in its eighth year, is undeniable. According to a survey conducted last year, 75% of parents said the course increased their knowledge of financial topics, and 92% began using a budget. But success is judged by more than just numbers. It’s also defined by parents adopting healthy, positive habits and modeling them at home for their children.

Cynthia, for example, often talks with her children about money. “I show them how much Dad and I bring home from our paychecks. I tell them what we pay for rent and other bills, and how much we have left over,” she says. “I also tell them how much rent is going for. It may be 10 times worse when they get my age, and they don’t want to go through that process. I tell them it’s best to go to college, be what you want to be, buy your home and you’ll be good.”

Even though she’s completed the financial literacy course, Cynthia’s interested in taking it again, because she’s certain there are things she missed the first time around. Plus, she says, “it’s always good to learn more.”

In the meantime, Cynthia and her husband are working toward buying a home, perhaps in the Orlando area. She’s also relishing the relief that comes from being debt-free. Every so often, she hears commercials on the radio claiming to help repair bad debt. “It’s just a rip off,” she laughs. “I’m living proof, because I wanted to go through that [type of debt repair program] ― until this class came along.”